Carbon Offsetting Pricing and Future: 7 Powerful Insights Shaping a Sustainable Tomorrow

Published on February 5, 2026 by Dr. Ahmad Mahmood

Introduction to Carbon Offsetting Pricing and Future

The conversation around climate change has moved from whether action is needed to how fast and how effectively it can be taken. At the center of this shift lies carbon offsetting pricing and future, a topic that now influences corporate strategy, government policy, and consumer behavior worldwide. Carbon offsetting allows individuals and organizations to compensate for their greenhouse gas emissions by investing in projects that reduce or remove carbon dioxide elsewhere—such as reforestation, renewable energy, or carbon capture initiatives.

Understanding carbon offsetting pricing and future is critical because pricing determines accessibility, credibility, and long-term impact. If offset prices are too low, they may fail to drive meaningful climate action. If they are too high, adoption may slow, especially in developing economies. This delicate balance makes pricing one of the most important factors shaping the future of carbon markets.

In this comprehensive guide, we explore how carbon offset prices are set, what factors influence them, current market trends, and where the future is heading. Whether you’re a business leader, sustainability professional, or climate-conscious individual, this article provides clear, trustworthy insights grounded in experience, expertise, and authority.

Understanding Carbon Offsetting: A Foundational Overview

Carbon offsetting is a mechanism that enables emitters to balance unavoidable emissions by supporting verified projects that reduce or remove greenhouse gases. These projects generate carbon credits, with each credit typically representing one metric ton of CO₂ equivalent reduced or removed.

How Carbon Offsetting Works

- Emissions are calculated using standardized accounting methods.

- Equivalent carbon credits are purchased from certified projects.

- Independent verification ensures emissions reductions are real, additional, and permanent.

Carbon offsetting pricing and future discussions often begin here because the credibility of offsets directly affects their price and long-term viability.

Types of Carbon Offset Projects

- Renewable energy (wind, solar, hydro)

- Forestry and reforestation

- Methane capture

- Carbon capture and storage (CCS)

- Community-based efficiency projects

Each project type carries different costs, risks, and verification requirements—factors that strongly influence pricing.

How Carbon Offsetting Pricing Is Determined

Carbon offset prices are not arbitrary. They reflect a complex mix of economic, environmental, and regulatory factors.

Supply and Demand Dynamics

When demand for offsets rises—often driven by corporate net-zero commitments—prices tend to increase. Conversely, an oversupply of low-quality credits can depress prices and undermine confidence in the market.

Project Quality and Verification

High-integrity projects that meet strict standards command higher prices. Credits verified by internationally recognized standards such as the Gold Standard or Verra are generally more expensive due to rigorous auditing and monitoring requirements.

Geographic Location

Projects in developing regions may have lower operational costs, but political risk and long-term permanence can affect pricing. Conversely, projects in stable regions often cost more but offer higher confidence.

Current Carbon Offsetting Price Ranges

Today, carbon offset prices vary widely depending on quality and project type.

| Offset Type | Typical Price Range (USD/ton) |

|---|---|

| Low-quality avoidance projects | $1 – $5 |

| Renewable energy offsets | $5 – $15 |

| Forestry & reforestation | $10 – $40 |

| Carbon removal (DAC, biochar) | $50 – $300+ |

This wide range highlights why carbon offsetting pricing and future debates focus heavily on quality over quantity. Cheap offsets may look attractive, but they often fail to deliver long-term climate benefits.

Voluntary vs Compliance Carbon Markets

Carbon offsetting pricing and future trends differ significantly between voluntary and compliance markets.

Voluntary Carbon Markets (VCM)

These markets allow companies and individuals to purchase offsets voluntarily. Pricing is flexible and driven largely by corporate sustainability goals and consumer expectations.

Compliance Carbon Markets

Regulated markets, such as cap-and-trade systems, require participants to offset emissions by law. Prices are typically higher and more stable due to regulatory enforcement.

Examples include the EU Emissions Trading System and regional cap-and-trade programs. While voluntary markets currently dominate innovation, compliance markets often set the long-term price floor.

Corporate Net-Zero Commitments and Their Impact on Pricing

One of the strongest drivers of carbon offsetting pricing and future trends is the surge in corporate net-zero pledges. Thousands of companies have committed to reducing emissions and offsetting residual footprints by mid-century.

Why Corporations Are Paying More

- Brand reputation and stakeholder trust

- Investor pressure for credible climate action

- Alignment with global climate goals

As companies prioritize high-quality offsets, demand for premium credits rises—pushing prices upward and reshaping the market.

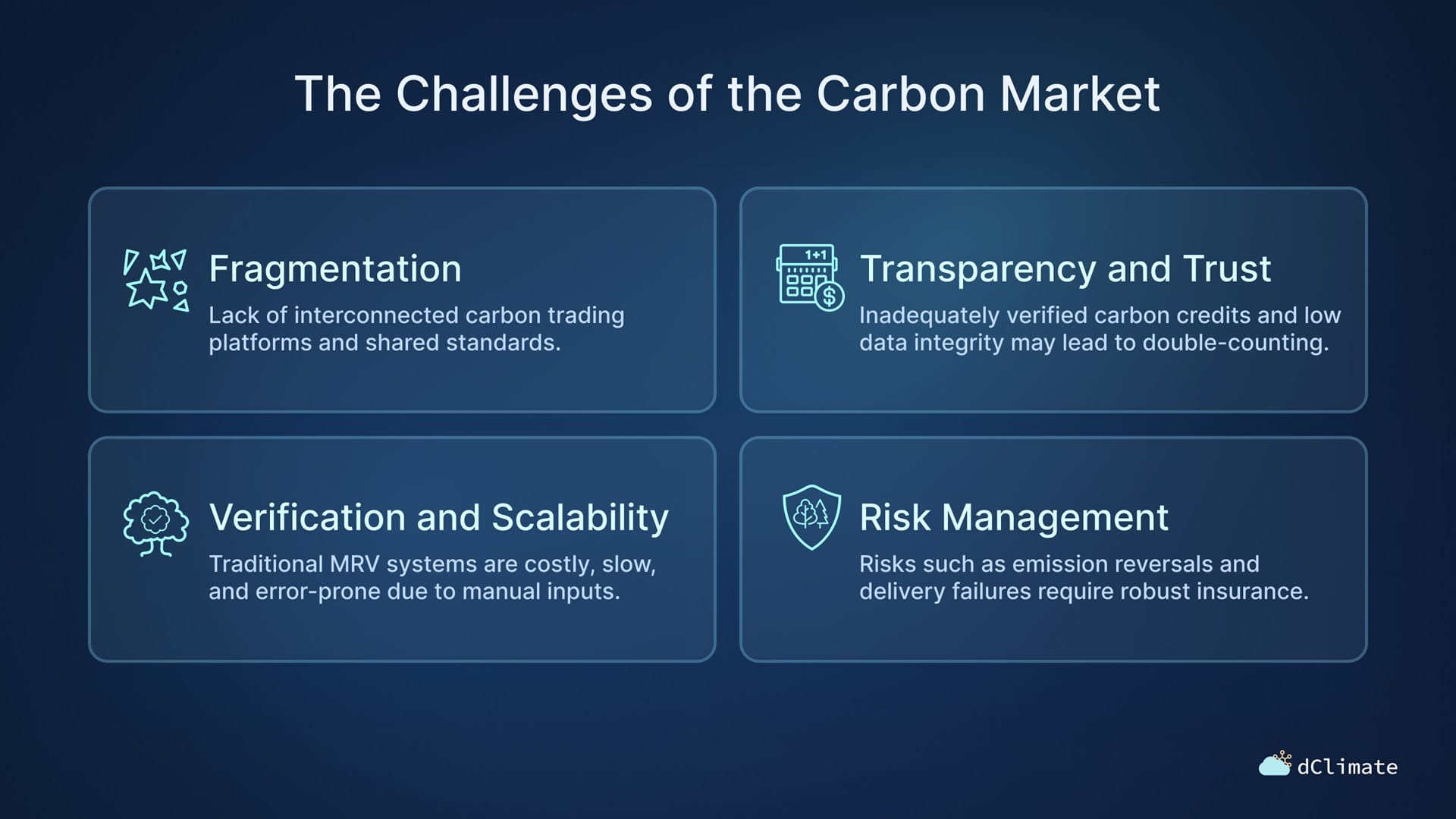

Challenges Facing Carbon Offsetting Pricing Today

Despite rapid growth, carbon offset markets face several challenges.

Greenwashing Concerns

Low prices often raise red flags about project legitimacy. When offsets are used as a substitute for emissions reduction rather than a complement, public trust erodes.

Lack of Price Transparency

Unlike traditional commodities, carbon credits lack standardized pricing benchmarks, making it difficult for buyers to assess fair value.

Permanence and Additionality

Forestry projects, for example, face risks from wildfires or land-use changes. These uncertainties affect pricing and long-term confidence.

The Role of Technology in Carbon Offsetting Pricing and Future

Technology is rapidly transforming how offsets are measured, verified, and priced.

Blockchain and Digital MRV

Blockchain-based systems improve transparency by tracking credits from issuance to retirement. Digital Measurement, Reporting, and Verification (MRV) reduces costs and increases trust.

AI and Satellite Monitoring

Advanced analytics and satellite imagery allow real-time monitoring of forestry and land-use projects, reducing uncertainty and improving price stability.

As technology lowers verification costs, carbon offsetting pricing and future markets may become more efficient and accessible.

Carbon Removal vs Carbon Avoidance: Pricing Differences

Not all offsets are created equal. A critical distinction exists between carbon avoidance and carbon removal.

- Avoidance: Prevents emissions that would have occurred (e.g., renewable energy).

- Removal: Actively removes CO₂ from the atmosphere (e.g., direct air capture).

Removal credits are significantly more expensive but are increasingly viewed as essential for achieving true net-zero. This shift is expected to redefine carbon offsetting pricing and future market structures.

Policy, Regulation, and Global Climate Goals

Government policy plays a decisive role in shaping carbon markets. International agreements such as the Paris Agreement encourage nations to reduce emissions and create mechanisms for carbon trading.

Stronger regulations typically lead to:

- Higher minimum prices

- Improved project quality

- Greater market stability

As climate policies tighten, carbon offsetting pricing and future trends are likely to reflect increased regulatory oversight.

Future Price Projections for Carbon Offsets

Most experts agree that carbon offset prices will rise significantly over the next decade.

Key Drivers of Price Increases

- Growing demand from net-zero commitments

- Limited supply of high-quality credits

- Stronger regulation and standards

- Shift toward carbon removal solutions

Some forecasts suggest average prices for high-integrity offsets could exceed $50–$100 per ton by 2030, particularly for removal-based credits.

Carbon Offsetting Pricing and Future for Businesses

For businesses, understanding carbon offsetting pricing and future trends is no longer optional—it’s strategic.

How Companies Can Prepare

- Prioritize emissions reduction first

- Budget for rising offset costs

- Invest early in long-term offset partnerships

- Focus on transparency and credible reporting

Early movers often secure better pricing and build stronger sustainability reputations.

Impact on Consumers and Everyday Choices

Consumers also influence carbon offsetting pricing and future outcomes through purchasing decisions.

- Supporting brands with credible climate strategies

- Choosing verified offsets for travel and events

- Demanding transparency and accountability

As awareness grows, consumer pressure will continue to push markets toward higher-quality, higher-priced offsets.

Frequently Asked Questions (FAQs)

1. What is carbon offsetting pricing and future focused on?

It focuses on how carbon offset prices are determined today and how they are expected to change as climate action intensifies globally.

2. Why do carbon offset prices vary so widely?

Prices vary due to project type, quality, verification standards, location, and long-term risk.

3. Are cheap carbon offsets reliable?

Not always. Extremely low prices may indicate poor verification or limited climate impact.

4. Will carbon offset prices increase in the future?

Yes. Most experts expect prices to rise as demand grows and standards become stricter.

5. Is carbon offsetting enough to fight climate change?

No. Offsetting should complement, not replace, direct emissions reduction.

6. How can businesses manage future offset costs?

By reducing emissions early, investing in high-quality projects, and planning for long-term price increases.

Conclusion: The Road Ahead for Carbon Offsetting Pricing and Future

Carbon offsetting pricing and future trends point toward a more mature, transparent, and impactful market. As technology improves, standards tighten, and demand grows, prices will increasingly reflect true climate value rather than short-term convenience. While challenges remain, the future of carbon offsetting holds significant promise—provided it is guided by integrity, innovation, and genuine commitment to sustainability.

Organizations and individuals who understand these dynamics today will be best positioned to lead tomorrow’s transition to a low-carbon world.